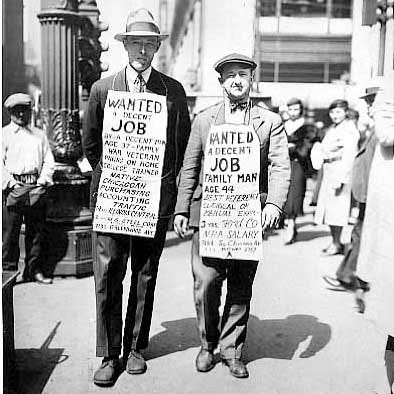

The Great Depression, which lasted from 1929 to 1939, was one of the most severe economic downturns in history. During this period, wages and home costs fell significantly. Comparatively, the economy in 2023 has seen remarkable growth in average wages and home costs. However, when juxtaposing the wages and home prices, it's evident that the ratio of home cost to wages has widened unfavorably for today's population.

Wages During the Great Depression

During the Great Depression, wages were significantly lower than they are today. In the 1930s, the U.S. average hourly starting wage for unskilled adult male labor was 45¢ per hour for white individuals and 35¢ per hour for black individuals. In 1939, the annual median wage for full-time, year-round white male workers was $1,419, while for white female workers, it was $863. Black male workers earned an annual median wage of $639, and black female workers earned $3271.

Home Costs During the Great Depression

In contrast, the average home prices during the Great Depression remained relatively stable. According to Schiller’s index, inflation-adjusted home prices fell by approximately 7% between 1929 and 1933. However, by 1940, home prices had rebounded and even surpassed their 1929 levels2.

Wages in 2023

Fast forward to 2023, and the economic landscape has changed dramatically. According to the latest data from the U.S. Bureau of Labor Statistics (BLS), the annual mean wage for a full-time wage or salary worker in the United States is $53,4903.

Home Costs in 2023

Regarding home costs in 2023, the median home sales price in the United States is $436,800. This represents a staggering increase compared to historical prices. For instance, in 1980, the median home sales price was $63,700. By 2020, it had risen to $329,000, and by the first quarter of 2023, it surged to $436,8004.

Ratio of Home Costs to Wages

In the Great Depression, the ratio of average home cost to average wages was approximately 4:1. Using the data from 1939, where the median wage for white men was $1,419 and assuming a similar home price as in 1933 (around $4,000), this ratio is confirmed.

In contrast, the ratio in 2023 is much higher. With an average wage of $53,490 and an average home cost of $436,800, the ratio is approximately 8:1. This indicates that, despite higher wages, homes have become relatively more expensive for the average person today compared to the Great Depression era.

Conclusion

The analysis reveals that although nominal wages have significantly increased since the Great Depression, the affordability of homes relative to wages has deteriorated. The current ratio of home prices to wages is nearly double that of the Great Depression period. This reflects the erosion of purchasing power and the relative devaluation of the currency over time. Such insights underscore the importance of considering wage growth in conjunction with inflation and the cost of living to gain a more comprehensive understanding of economic well-being across different time periods.